What is the impact of fintech? The impact of Fintech, according to the Financial Stability Board, is financial innovation that is technologically enabled and may lead to new business models, applications, processes, or products, all of which could have a material impact on financial markets and institutions as well as the provision of financial services.

The term “fintech” stands for the Revolution of “finance and technology.”

Fintech refers to providing financial services online. This fintech innovation might contain everything from mobile payment apps to mobile banking apps, blockchain, and cryptocurrency, stock trading, etc.

EXAMPLES OF FINTECH

What is the example impact of fintech? .Currently, wealth front, personal capital, and kaboodle are at the top of the list. They have all made a big contribution by providing retail banking and the financial services sector with unrivaled FINTECH offerings.

Who are Fintech companies

Fintech is just the combination of finance and technology, Fintech companies are those institutions that make use of technology to improve financial status.

They use technology to automate and facilitate payment processing to make it easier for humans.

With the use of Fintech, you can easily transfer payment from your device to another user’s account.

Since the emergence of Fintech stress and rate of cueing on the bank has been drastically reduced.

Remember, Fintech companies are those institutions that combine technology to establish easy financial access.

Why is Fintech important

The importance of Fintech can not be underrated, countless reasons made Fintech to be very useful and important. They include the following.

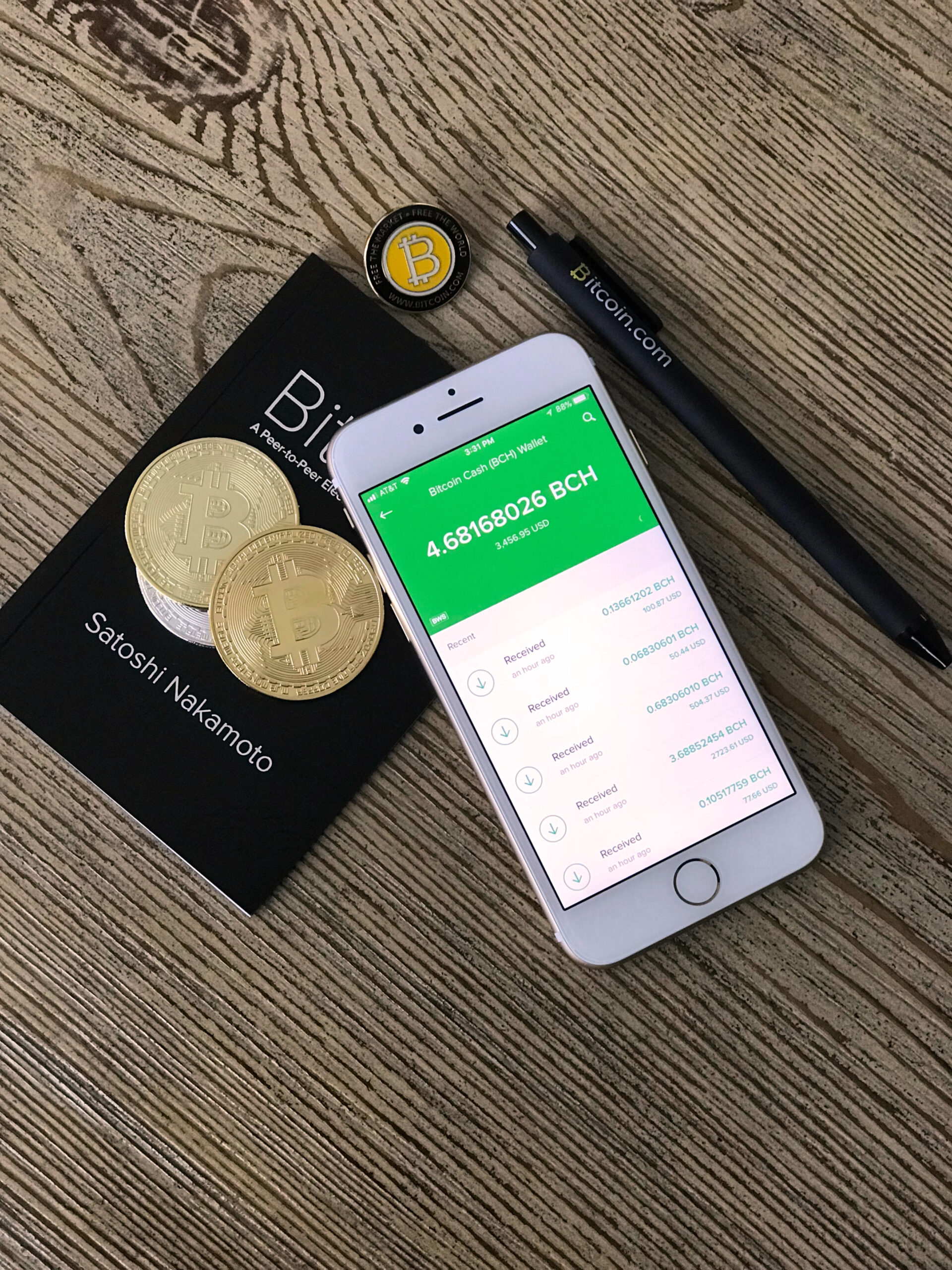

- Fintech creates wealth through technology: Fintech has Advanced in creating wealth opportunities for people, many can now make money online through Fintech, for example the trade of cryptocurrency.

Cryptocurrency trading was developed with the help of Fintech, since its existence till date many have been mining wealth from it.

Many have become billionaires by simply trading cryptocurrency, this is one of the usefulness of Fintech.

- Makes banking easier: the transfer of money and making of payments have been easier since the existence of Fintech.

OTHER FINTECH EXAMPLES?

What is another example of fintech? Fintech has been used in numerous financial fields. Here are a few illustrations.

- You can buy and sell stocks, ETFs, and cryptocurrencies with ease from your mobile device using investment apps like Robinhood, frequently with little to no commission.

- Paying people or businesses online and instantly is made simple by payment apps like Paypal, Venmo, Block (Square), Zelle, and CashApp.

- Robo-advisors are software programs or internet services that automatically invest your money in the best possible ways and are available to regular people.

- Through P2P lending sites like Prosper, Lending Club, and Upstart, consumers and small business owners can borrow money from a variety of people who are directly lending them microloans.

- Apps for managing personal finances including Mint, YNAB, and Quicken SimpliFi offer you the ability to manage all of your money in one location, create budgets, pay bills, and more.

The application of technology specifically to the insurance industry is known as insurTech. One illustration would be the employment of tools to track your driving and modify auto insurance premiums.

- Cryptocurrency apps, such as wallets, exchanges, and payment processors, enable you to store and use digital currencies and tokens like Bitcoin and NFTs.

Fintech encompasses items from new businesses, driven by consumer demand for underserved markets, as well as developments from banks that use cutting-edge technology to improve internal operations and the customer experience. Examples include credit-scoring algorithms for quicker mortgage approval and infrastructure support services like data and compliance systems.

Additionally included in fintech is technology innovation created by (or for) current financial institutions to improve client experiences and streamline internal operations.

- What is the importance of fintech? One of the importance of Fintech is that it has created a successful ecosystem by fusing concepts from the conventional system with the most recent developments.

- With Fintech, businesses have developed incredible data products and services that make life easier for customers.

- Financial technology is used to automate financial services. It has aided both businesses and individual users in effectively managing their financial operations.

- People are more driven to be in charge of their decisions, thanks to Fintech, which has increased financial literacy.

- The industry has used software, algorithms, programming languages, data analysis, machine learning, and other cutting-edge advancements to develop new digital products for clients

What are the categories of fintech users...

The categories of fintech users fall under four different categories.

- B2B for banks

- Business clients

- B2C for small businesses,

- Consumers.

All four groups will have the opportunity to interact in previously unheard-of ways as a result of trends toward mobile banking, increased information and data, more precise analytics, and decentralization of access.

With regard to customers, the younger you are, the more likely it is that you are familiar with Fintech and can define it precisely. Given their enormous size and expanding earning (and inheritance) potential, millennials are actually the primary target of consumer-focused Fintech. Some observers of the Fintech industry think that the emphasis on millennials is due more to the size of that market than to the Fintech proficiency and interest of Gen Xers and baby boomers.

Instead, because it doesn’t address their issues, Fintech frequently has little to offer to older consumers.

A business owner or startup would have gone to a bank to acquire finance or startup money prior to the development and use of Fintech. They would need to build a partnership with a credit provider and even install equipment, such as a landline-connected card reader if they wanted to take credit card payments. Nowadays, those obstacles are a thing of the past thanks to mobile technology

what does fintech offers?

Fintech offers Excellent Career Development Opportunities:What is fintech offering?: There is a ton of space for professional advancement within this industry. Many businesses provide training programs that could aid in your acquisition of crucial technical skills. Additionally, you get to operate in a team setting. While working on a project, you’ll most likely collaborate with other Fintech industry experts. Utilizing your technical expertise, you may create innovative solutions and cutting-edge technologies.

Fintech Offers A Groundbreaking Variety Of Employment Possibilities: You might picture software developers and coders when you think of Fintech. Although these are potential career paths, the sector offers many more, including public relations, project management, sales management, and business development management.

Fintech creates a healthy startup culture: A healthy startup culture is being created by Fintech because many Fintech businesses start out that way. If you appreciate the energy of this sector and the many responsibilities that come with it, Fintech can be a good fit for you. You can use this as an opportunity to express your creativity. The creation of new software and apps by financial institutions continues to improve people’s lives. You might be able to use your original thinking to create something that makes people’s daily lives better.

what is the future of fintech?

What is the future of fintech: Early adopters of Fintech will begin to outperform rivals; Institutions that cut back on digital investments amid next year’s economic uncertainty will have difficulties in the future, just as banks and credit unions that didn’t have an aggressive digital strategy over the past decade are still fighting to catch up. The institutions that supported digital branches during the Great Recession, on the other hand, are well ahead of those that did not. As early users of Fintech solutions start to distance themselves from their traditional rivals, this trend will last well into 2023.

The main difference is that forward-thinking FIs will shift their emphasis from digital deployment to digital excellence. To put it another way, they won’t just be concerned with having a digital platform, but also with important needs like user experience (UX) and user interface (UI). Apps that may be easily customized and used are essential. Many people want for a single financial hub where they can access both more contemporary services like personalized financial wellness advice and information, as well as more classic banking activities like writing checks. FIs that offer a digital financial ecosystem will do better than rivals that offer fewer features.

This trend will benefit Fintechs that drive greater UX and UI through graphical enhancements and value-added services.

Fintechs will need to show more teeth than just talk: What is fintech needed to show? The majority of consumers are turning digital and putting additional demands on their banks. Therefore, FI leaders must seriously think about making a purchase of a financial wellness product. Before selecting a product, they must exercise prudence and keep themselves informed. Fintechs will succeed in the end if they provide a clear ROI and improve connections between consumers and banks.

Consumers are increasingly turning to technology and apps to help them find the financial counsel they need. In fact, more than 40% of core retail banking sales in 2021 were initiated via digital means. Beginning in 2023 and extending well into the future, this tendency will significantly aid in the growth of the Fintech industry.

Renewed Fintech investment from top FIs: Uncertain economic conditions will inevitably lead to a decline in digital spending by some banks and credit unions. By doing this, companies will inevitably limit the number of new features that are added to or improved upon within their digital platforms. Since about 80% of Americans now prefer to deal with their bank through digital means, the costs resulting from a diminished online presence might be significant.

High-performing FI CEOs will decide not to reduce their digital spending in light of this. Instead, they will increase their investment in 2023, providing services like credit score solutions and tools for financial wellness to their mobile users.

This ground-breaking tactic will direct more users to mobile wallets (and away from rival Fintechs that might inhibit a FI’s ability to market to and finance with its users).

A digital-first approach to banking is always wise, but given the gloomy economic forecast for the coming year, it will be much more important. The most value for their money is currently being sought for by forward-thinking FI executives. Traditional FIs have the chance to concentrate their rehabilitation efforts on the most people at the most advantageous times thanks to the congested digital market.

CONCLUSION

Since FINTECH is here to stay, innovate, and transform the way business is now conducted, it cannot be dismissed as just another innovation. As a result, we must be well-versed in financial services, mobile payments, online trading, mobile banking, payment methodology, third-party integration, secure payments services, and related requirements.

2 comments

I need to to thank you for this great read!! I definitely loved every little bit of it. Ive got you saved as a favorite to check out new things you postÖ

it’s a pleasure to read your comment, kindly subscribe to read more about trends in technology